Protecting Your Equity: Cash vs. Financing What offer should I Accept?

This article is for all homeowners that want to sell my house fast in Stockton. The world does not want to cooperate and you really need to know at least two things about the real estate market and offers that you are going to receive. First, you need to have a good idea about what your house is worth and be armed with the knowledge to evaluate the offers that come in. You also need to know that your house is competing with every other house at so many different levels. Location, condition, age and price. All sellers have one thing in common. They want to sell their house for the highest dollar amount while spending the least amount of money so they can put the most amount of money back in their pocket. That is your EQUITY.

This article is for all homeowners that want to sell my house fast in Stockton. The world does not want to cooperate and you really need to know at least two things about the real estate market and offers that you are going to receive. First, you need to have a good idea about what your house is worth and be armed with the knowledge to evaluate the offers that come in. You also need to know that your house is competing with every other house at so many different levels. Location, condition, age and price. All sellers have one thing in common. They want to sell their house for the highest dollar amount while spending the least amount of money so they can put the most amount of money back in their pocket. That is your EQUITY.

In the eyes of the buyer, it is the product (your house), its condition and the location compared to the rest of the market. So to them, price is what matters the most when viewed through the prism of value. Buyers are looking for a move in ready house with real value. They dont want any problems.

So, in this tug of war between the seller (that just wants to sell my house fast in Stockton) and the buyer that wants to get as much value for their money, how does a seller evaluate the offers that they can hope to see? Let’s start at the beginning…

The housing market has changed dramatically over the past 10 years. Ever since the real estate bubble burst, new housing has lagged behind all other market indicators. Today it is pretty much the same story except that housing prices have seen substantial gains year after year and that has been driven by three factors.

- Virtually no new homes are being built in the under $300,00 price range

- Limited inventory of existing houses for sale

- interest rates have remained relatively stable in the past year and the Fed is talking about maintaining interest rates for fear of inflation.

As a result sellers have remained in control of the market with prices approaching levels that were achieved before the bubble burst. There is hardly a fear that there is another bubble because of two very real factors;

- Lenders have been hamstrung by legislation, such as Dodd Frank that attempts to regulate and control Mortgage lending industry. The effect of the legislation has been to constrict lending at all levels and as a result even the mega qualified are limited to the the number and types of mortgages that they can have. This includes commercial borrowers that include seasoned real estate investors

- a lack of new housing starts that make the existing home market the only product available for most buyers.

Today’s real estate market is pretty much driven by supply and demand with one exception. The the housing supply line is pretty stagnant right now and without a new and constant supply of new houses coming online, prices will continue to rise as there are no alternatives to compete with the existing house market. That is good news for homeowners that want to sell their houses in Stockton as prices are reaching pre-recession levels. Homeowner equity is for all purposes restored.

Today’s real estate market is pretty much driven by supply and demand with one exception. The the housing supply line is pretty stagnant right now and without a new and constant supply of new houses coming online, prices will continue to rise as there are no alternatives to compete with the existing house market. That is good news for homeowners that want to sell their houses in Stockton as prices are reaching pre-recession levels. Homeowner equity is for all purposes restored.

All industries go through change and consolidation and we may be at that point in the housing market. At least with the buying and selling of homes. The car industry figured it out a long time ago. They realized that different customers want vastly different options and some are willing to pay top of market to get what they want, while others are just not interested.

The real estate market is no different and with so many different entry points it’s no wonder that sellers and buyers get confused when evaluating houses. age, condition, updates and upgrades. Every house is different. A Pool, no pool, a deck, a garden, morning sun, trees, solar, linoleum, tile, sprinklers with timers. The options are endless and with so many common traits how do you really know what that price point is gong to be.

For the homeowner/seller it’s all about equity, risk and time frames. For the buyer it’s about condition and value. Both the Seller and Buyer are usually represented by real estate agents that run their own comparative market analysis to determine what the house is worth all the while knowing that what they say doesn’t really matter because 99% of all homes sold require financing and that means there is going to be an appraisal.

There are only two types of buyers. Cash and those that require financing. The following lists types of Buyers Loans in order of least risk to the seller and the bank;

- Cash Offer (No lender required, no real risk for Seller, except for inspections and appraisals, timeframes are more stable)

- Conventional Loan (requires 20% down payment, banks still need to appraise and approve and inspections can make it more risk prone)

- VA Loan (can require as little as 1% down very risky because inspections, appraisals and approvals are very rigid with livability standards for the house) Big Advantage over FHA because the VA wants to place veterans in houses so they push for approvals)

- FHA Loan (can require as little as 1% down, virtually the same as VA today except that lenders are not proactive as VA in getting buyers in houses)

- CALHFA (Buyer down payment assistance) A secondary loan program. Very risky with major delays in approvals and funding. Very risky for sellers.

Even the appraisal process is a bit flawed because it only takes into consideration the visual evaluation of the home and does not account for its true physical health and condition. That is why the term putting lipstick on a pig is so relevant in today’s real estate market. It is also why in 98% of all buyers (cash included) want at least one but as many as 3 home inspections. Buyers dont like surprises and they certainly dont want to pay top dollar only for a seller to transfer their problems to the buyer through a sale.

Also know that when it comes down to evaluating offers, when all other factors are equal, cash is king.

Negotiating the sales price for a house that you own is not always as simple as it sounds. With all offers, you need to evaluate the different exclusions, concessions, and contingencies that you receive to understand exactly how they are different and how they will impact the amount of cash you will receive when the transaction finally closes.

Negotiating the sales price for a house that you own is not always as simple as it sounds. With all offers, you need to evaluate the different exclusions, concessions, and contingencies that you receive to understand exactly how they are different and how they will impact the amount of cash you will receive when the transaction finally closes.

Most sellers dont pay attention to the other cost that they have until the house sells and those are the holding cost. Buyers need to be reminded that those cost are real and are part of the comparison process. The difference between a 30 day close and 45 days could actually be as much as two mortgage payments when the sale finally closes.

Not all offers are created equal and sometimes a minor difference can cost you thousands of dollars. So when Comparing Cash and Financing Offers When Selling Your House I would suggest that it is easier to have an experienced third party insulate the process (a good real estate agent or accountant or financial adviser) as they can provide two things; 1) a pause in the negotiation if needed and 2) an independent sounding board where pricing strategy can be discussed without the buyer present. It can be a real advantage in getting what you want.

For the most part I don’t use the services of a real estate agent as a seller because I like to negotiate directly with buyers and buyers agents, but unless you are experienced at it or laser focused on the numbers it can be a good idea to be able to bring outside input and in some cases a pause to the negotiations at one point or another.

Comparing Cash and Financing Offers to Sell Your House

Patience or Unrealistic Expectations?

So at what point is a financed offer worth more than an all cash offer? Say for a moment that a buyer walked in off the street and was not represented by a real estate agent. What if as the seller you knew that the $295,000 asking price was a little high and also knew that with the absence of the 3% – 6% sales commission, you could accept less than a full asking price because of the savings on commission alone. But, you also want to factor in the other variable cost… like holding cost (utilities, mortgages, insurance, property taxes, maintenance, etc). Most people look at the big number and forget about the many little ones that tend to add up quickly. Always remember that your holding cost are more significant than you might think and they they come right off of the top after your closing.

It really makes you stop and think. “Is Cash King”? “At what point am I not willing to accept an all cash offer over an offer with financing”?

In most cases Cash is considered the best bet, because you don’t have to take your chances with a buyer who may never qualify for the loan. It is not unheard of for banks to decline a loan 28 to 35 days into an escrow period. Sellers tend to forget that in today’s world buyers need to jump through hoops to get a mortgage to buy your property.

The Advantage of Cash

In any real estate transaction you need to determine the context of the offer and the ability of the home buyer to actually close. As a rule, a cash offer should always be considered, because a failure to obtain financing is the main reason why most home sales fail to close. In fact, according to Zillow, 1 in 3 Mortgages fell out of escrow due to financing in 2014.

In any real estate transaction you need to determine the context of the offer and the ability of the home buyer to actually close. As a rule, a cash offer should always be considered, because a failure to obtain financing is the main reason why most home sales fail to close. In fact, according to Zillow, 1 in 3 Mortgages fell out of escrow due to financing in 2014.

In the new era of Dodd Frank and strict lending criteria, the addition of TRID , some buyers will not qualify for a mortgage. In other scenarios, lenders won’t approve financing because the appraisal comes in lower than the purchase price. Keep in mind that with a Cash Offer there is no lender and there are typically no appraisals, so both of these risks are usually eliminated.

Not all Houses/Offers are Created Equal

Most home Sellers don’t ever see a cash offer because most Home Sellers have homes that are in market ready condition, can pass multiple inspections, have minimal appraisal issues (if priced right) and are represented by a real estate agent willing to list it. This is the “sweet spot” for both the home seller and the real estate agent. 98% of the offers received on this type of house will include bank financing. It is rare for these home sellers will ever see a cash offer.

So what happens when the House in question has so many issues of deferred maintenance, title issues or code violations that can’t be financed by any bank? What is a home seller supposed to do?

The answer is really simple: When the asset becomes a liability and starts to slowly drain your others assets it’s just time to sell. Forget about losing value, I am talking about a house that will never be worth more than it is right now. Ask yourself the hard questions am I ever going to be able to afford to fix it up? Am I ever going to see a profit? Unfortunately most people don’t realize that an asset that continues to deteriorate and becomes a burden is no longer an asset. It’s time to sell.

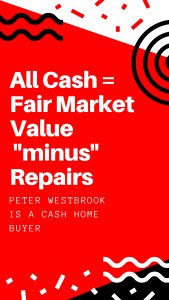

The Cash Discount = (Fair Market Value – Repairs – Some Holding Cost)

The Cash Discount = (Fair Market Value – Repairs – Some Holding Cost)

As I stated above, most home Sellers do not ever see a cash offer because most cash buyers are investors are not paying a fully loaded retail price. Most real estate investors are looking to pay fair market value minus the cost of repairs and some holding cost. According to recent research by Goldman Sachs, Investors offers almost always come at some sort of discount, but when you roll the commissions back in there is a more equitable balance when you compare. You can take the all-cash offer, and it’s a safe bet that you’ll get your cash at the end of the day when the transaction closes. The trade off however is that Cash Home Buyers in California will usually buy a house in its current as is condition without contingencies, without inspections and without repairs and updates and without appraisals. Imagine not having to pay for any repairs, complying with codes for Non-permitted work or even cleaning up. Most investors even pay the closing cost.

How Big a Risk is the Financed Buyer?

Many buyers come to the table pre-qualified for a loan. But pre-qualification letters are NOT approvals that have been reviewed by underwriters. They are a quick glance at a person’s credit with a stated income and NO Verification of the details. They are virtually a guess for approval and hardly a sure thing.

To illustrate, some lenders will take the time to verify the borrower’s complete financial picture; others will take a few details over the phone and deliver an opinion… hardly an approval. As the seller you need to talk to the lender directly and verify how well vetted the buyer is. It is your business. The buyers are asking you to pull your house off the market for a period of time while they negotiate with their lender about buying your house. Typically they will want 30 days to do that. When you say yes, or accept the offer with a contingency for financing you have essentially placed a bet on the buyer. Shouldn’t that bet be as well researched as possible. I dont know any sellers that want to start all over again but that is what happens when a loan is declined. One other thing sellers should know… In california, sellers do not get to keep the earnest money deposit if the sale falls apart because of financing. Heck, for any reason.

Talk to the Lender Directly and Verify What Pre Approved Means

If you are a seller and you are just looking to sell my house fast in Stockton, then you need to know that most Buyers are NOT pre-approved and pose a real risk to your sale of your house. The time frames are not real and some lenders string escrow periods out for as mush as 60 days. Sure its a real catch 22, but you have options an you need to exercise them. You want serious buyers, not tire kickers that might get lucky and get a loan. You need to know the difference?

If you are a seller and you are just looking to sell my house fast in Stockton, then you need to know that most Buyers are NOT pre-approved and pose a real risk to your sale of your house. The time frames are not real and some lenders string escrow periods out for as mush as 60 days. Sure its a real catch 22, but you have options an you need to exercise them. You want serious buyers, not tire kickers that might get lucky and get a loan. You need to know the difference?

Pre-approved buyers have passed the bank’s first extensive financial checks, including checks on credit ratings, earnings and debt-to-income ratio, but the early approvals are still not final approvals. Based on these checks, the lender makes a review credit decision – which means that the borrower in theory is good for the money he is borrowing. It’s not cash, and in today’s real estate market things can still fail the final underwriter approval. The Underwriter still needs to approve the loan.

Choosing the Best Deal

So now we know… the best offer is a cash offer at full asking price with no contingencies and closing in two weeks. Not surprisingly, these offers don’t come along very often. But when they do, the seller must often choose between a discounted cash offer and a higher financed offer. The buyer must also weigh in the cost of sales commission to a real estate broker (usually 4 – 6%), the holding cost and the closing costs. Which one is better depends on a host of factors: whether the financed buyer is pre-approved, the contingencies required; repairs needed or how quickly the buyer can close and whether there are other incentives on the table, such as the buyer picking up your closing costs. View the offers carefully because there’s a lot more to it than the asking price. Either way, don’t be pressured by your agent or anyone else into choosing any offer. You have the final say and should take the time to choose the offer you prefer.

Sometimes the certainty of closing is enough for people to want to go ahead with a cash offer, even if it’s lower than a conventional offer. To others, it doesn’t matter if their property falls out of escrow because of financing, as they are just waiting for the highest possible price without considering the overall cost.

Comparing Cash and Financing Offers Sell Your Stockton House.

Take your time, review the numbers and if you are focused on what you want, you will close with an offer that you are happy with.

My name is Peter Westbrook and I am a real estate investor in Stockton and “We Buy Houses in any condition in Sacramento, Stockton, Lodi, Modesto, Manteca and its surrounding areas”. We are the best at what we do because we work at it every day. We have years of experience and a plan that we follow. We are a real company with real people that are committed to helping you achieve your goals.

If you are saying “I need to sell my house fast in Stockton call us at (209)481-7780… we’d love to make you a fair no-obligation no-hassle cash offer. You’ve got nothing to lose, and we’d love to earn your business.